Cases

Carmen’s Corner Store v. SBA

CASE SUMMARY

Did we achieve our litigation objective? Yes, the client was allowed to apply for and did receive a PPP loan even though he was still on probation.

Court Outcome: After the SBA altered its rule three times during the trial, was ordered by the court to reserve money for our client, and eventually agreed to drop the rule, the U.S. District Court for the District of Maryland dismissed the case as moot.

Larger Impact: Congress never gave the SBA authority to implement its Criminal History Rule. SBA was forced to amend its rule to avoid exceeding the authority Congress granted to it. NCLA effectively won the case for our client and stopped an unlawful spending condition.

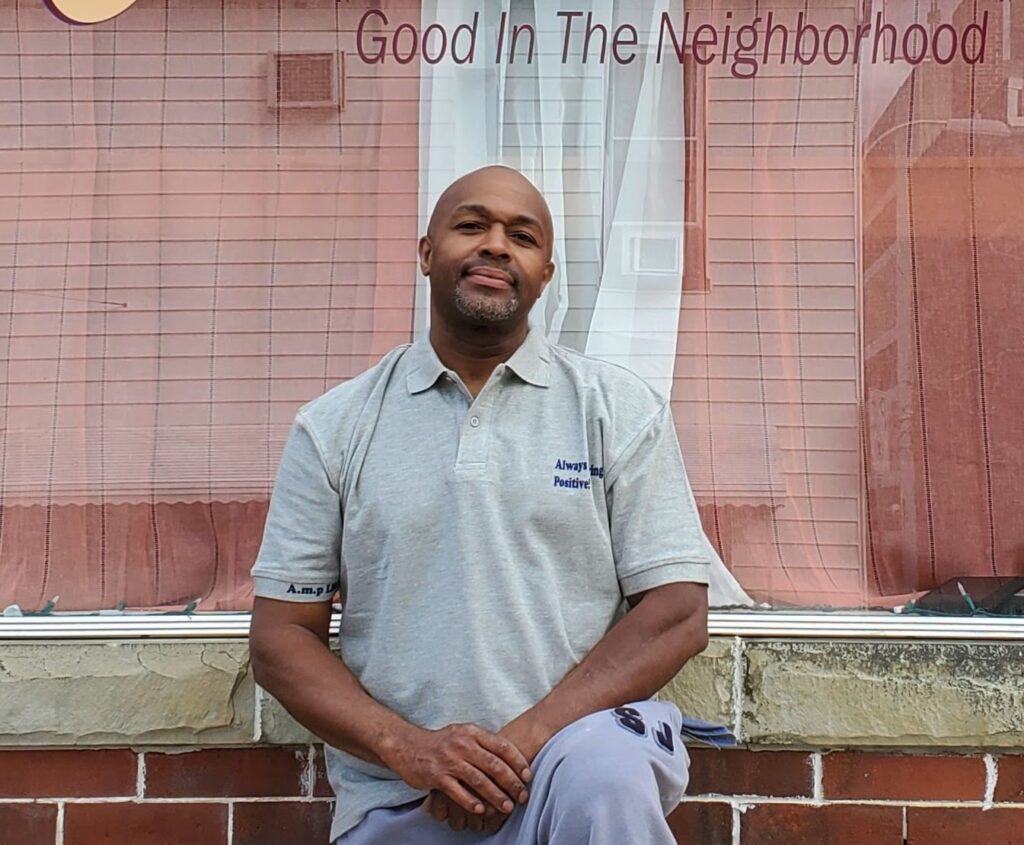

Summary: NCLA filed the complaint, Carmen’s Corner Store, et al. v. U.S. Small Business Administration, et al., in the U.S. District Court for the District of Maryland representing Altimont Mark Wilks, a small business owner from Hagerstown, Md., who was unlawfully barred from applying for PPP loans because he is still on probation. The suit challenged unlawful portions of the agency’s Interim Final Rule purporting to implement the Paycheck Protection Program (“PPP”) under the CARES Act.

Congress tasked SBA with managing the PPP loans—$659,000,000,000 in total—for businesses with fewer than 500 employees. Under the CARES Act, Mr. Wilks, owner of two such businesses, was fully eligible to receive the loans. However, SBA excluded certain types of businesses from being eligible—including enterprises owned by persons with a criminal history. When Mr. Wilks applied for much-needed federal assistance, SBA’s PPP “Criminal History Rule” unlawfully disqualified him, completely disregarding the intent of Congress to make loans available to all small businesses expeditiously during a national crisis.

Mr. Wilks has worked hard to redeem himself and become a contributing member of society with his enterprising spirit. In fact, community leaders throughout Maryland have recognized his successes. Local officials have repeatedly emphasized the positive impact that his business, Carmen’s Corner Store, has had on its low-income neighborhood by providing affordable goods. And his second business, Retail4Real, is a logistics company that trains ex-offenders to become bondable and dependable delivery drivers.

Due to the COVID-19 pandemic, both of Mr. Wilks’s businesses suffered significant financial losses.

SBA’s Criminal History Rule was an arbitrary and capricious exercise of power that exceeds the statutory authority that Congress delegated to the agency. NCLA asked the court to declare SBA’s administrative actions unlawful and ensure that PPP loans were available to all small businesses meeting the criteria Congress set.

RELEVANT MATERIALS

NCLA FILINGS

Order Granting Defendants’ Motion to Dismiss and Denying Plaintiffs’ Motion for Summary Judgment

February 17, 2021 | Read More

SBA’s Opposition to Summary Judgment and Reply in Favor of Dismissal

September 23, 2020 | Read More

Plaintiffs’ Memorandum of Law in Opposition to Defendants’ Motion to Dismiss & in Support of Plaintiffs’ Motion for Summary Judgment

September 9, 2020 | Read More

Order to Grant the Motion for Preliminary Injunction in Part and the Accompanying Memorandum

June 29, 2020 | Read More

Plaintiffs’ Memorandum in Reply to Defendants’ Opposition to Injunctive Relief

June 26, 2020 | Read More

PRESS RELEASES

NCLA Court Win Keeps SBA from Rewriting CARES Act to Exclude Small Biz Owners on Probation

June 30, 2020 | Read More

NCLA Lawsuit Forces Change in SBA Regulation to Make Hundreds of PPP Loan Applicants Eligible

June 26, 2020

NCLA Sues Small Business Administration for Denying PPP Loans to Applicants with Criminal Histories

June 11, 2020 | Read More

IN THE MEDIA

Interview with Jared McClain on WTIC-AM regarding the Carmen’s Corner Store v. SBA case

February 7, 2023

Businesses Fighting PPP Restrictions Win More Time to Apply

February 7, 2023

Loosening criminal history bar for COVID-19 loans does not moot lawsuit

February 7, 2023

SBA Changes PPP Criminal History Rules, Enabling More Businesses to Qualify for Loans

February 7, 2023

Interview With Attorney Jared Mcclain: SBA Unlawfully Denies Much-Needed PPP Loans

February 7, 2023

CASE HIGHLIGHTS

Media Mention

February 7, 2023

PPP wrongly denied to business owners with felonious past, lawsuit charges

Press Release

June 30, 2020

NCLA Court Win Keeps SBA from Rewriting CARES Act to Exclude Small Biz Owners on Probation

Filing

February 17, 2021

Order Granting Defendants’ Motion to Dismiss and Denying Plaintiffs’ Motion for Summary Judgment