Amicus Briefs

Clarke v. CFTC

CASE SUMMARY

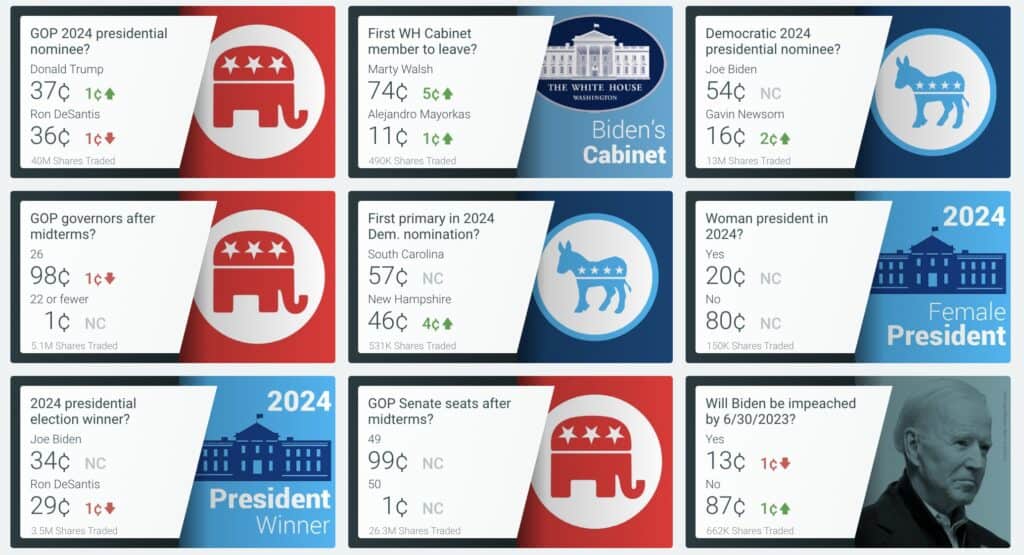

The PredictIt Market provides a platform for investors to trade contracts that predict the likely outcome of elections and other significant political events. In 2014, CFTC authorized the trading market’s establishment and assured its creators that the market could operate lawfully under the Commodities Exchange Act. After, millions of dollars and years of sweat equity have been invested to build and operate the market, CFTC pulled the rug out from under its operators and told them to shut everything down by the apparently arbitrary date of February 15, 2023—or else. Many thousands of third-party traders have invested in PredictIt Market contracts offered over the years—some of which remain open.

The Administrative Procedure Act (APA) requires courts to set aside agency action that is “arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law.” Clearing this low bar is the least we expect from unelected administrators entrusted to promulgate and enforce ever-expanding reams of regulation. Yet here, CFTC failed to clear the bar. The agency acted arbitrarily and capriciously by reversing course on PredictIt Market without considering reliance interests and providing a reasoned explanation for disregarding those interests.

In July 2023, the U.S. Court of Appeals for the Fifth Circuit ruled that CFTC’s threatened crackdown on the PredictIt Market without clear explanation was “likely arbitrary and capricious.” The Court ordered the U.S. District Court for the Western District of Texas to grant a preliminary injunction against CFTC’s action, a victory for NCLA.