Cases

Romeril v. SEC

CASE: Romeril v. SEC

STATUS: Closed

NCLA ROLE: Counsel

COURTS HEARD IN: SCOTUS, 5th Cir., S.D. NY

ORIGINAL COURT: U.S. District Court for the Southern District of New York

DECIDING COURT: U.S. Supreme Court

OPENED: May 6, 2019

AGENCIES: Securities and Exchange Commission

FOCUS AREAS:

CASE SUMMARY

Did we achieve our litigation objective? No, Barry Romeril was forced to abide by the SEC’s oppressive “gag rule” that prevents him from discussing his settlement or even proclaiming his innocence.

Court Outcome: The U.S. Supreme Court chose not to review the Second Circuit’s decision.

Larger Impact: This is one of many cases NCLA has brought to challenge the oppressive “gag” policy by which the SEC forces victims of its administrative enforcement actions to give up their First Amendment rights as a condition of settling their case. NCLA will keep pushing the SEC to abandon the gag rule.

Summary: When Barry D. Romeril settled with the United States Securities and Exchange Commission (SEC) in June of 2003 he didn’t know he would live to regret it 16 years later. That is because in order to settle his case, the SEC required that he agree to be bound by a Gag Order- a little known tool of the SEC meant to silence people for life regarding cases brought against them. NCLA moved to remove the gag order from his consent agreement, declaring it an unconstitutional prior restraint and content-based restriction on speech, abridging freedom of the press and Americans’ right to petition. In October of 2018, NCLA pioneered the legal challenges to this rule by petitioning the SEC to amend its gag rule, setting forth in detail the numerous constitutional and legal infirmities of this unconstitutional and disturbing practice.

RELEVANT MATERIALS

NCLA FILINGS

Petitioners Reply Brief

May 27, 2022 | Read More

Brief for Amicus Curiae Due Process Institute in Support of Petitioner

April 22, 2022 | Read More

Brief of Amicus Curiae Thomas More Society in Support of Petitioner

April 22, 2022 | Read More

Brief of Constitutional Law & First Amendment Scholars as Amici Curiae in Support of Petitioner

April 22, 2022 | Read More

Brief of Amicus Curiae Pelican Institute for Public Policy In Support of Petition for a Writ of Certiorari

April 22, 2022 | Read More

PRESS RELEASES

Prominent 1st Amendment Scholars, Investors and Think Tanks Support NCLA’s SCOTUS Cert Petition

April 25, 2022 | Read More

NCLA Petitions Supreme Court to End Decades-Long Suppression of Free Speech by SEC Gag Order

March 21, 2022 | Read More

NCLA Seeks En Banc Review of First Amendment SEC Gag Rule Case in Second Circuit

November 15, 2021

Second Circuit Decision in SEC Gag Rule Case Fails to Address Unconstitutionality of Lifetime Gags

September 27, 2021

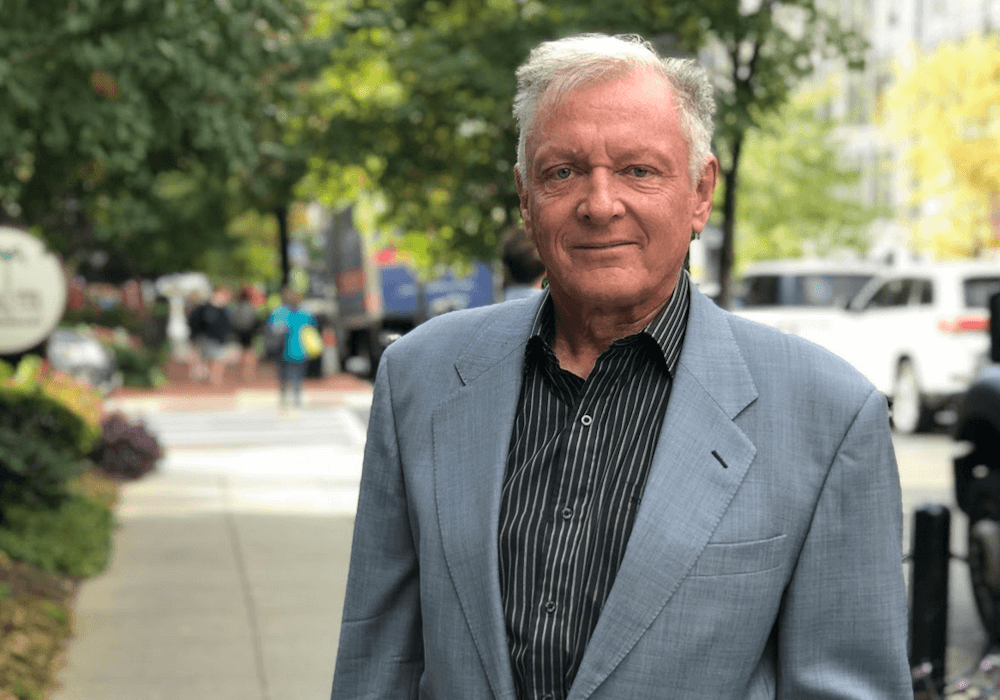

NCLA Launches Video of Former Chief Financial Officer of Xerox Silenced for Life by SEC’s Gag Rule

October 1, 2020 | Read More

IN THE MEDIA

Can the S.E.C. Require ‘Gag Orders’ When It Settles Cases?

The New York Times

February 7, 2023

Court upholds SEC gag rule for executives who settle

CFO Dive

February 7, 2023

2nd Circ. Denies Ex-Xerox Execs Bid To Toss SEC Gag Order

Law360

February 7, 2023

2nd Circuit rejects ex-Xerox execs challenge to gag order

Reuters

February 7, 2023

2nd Circuit Upholds SECs Use of Lifetime Gag Orders in Ex-Xerox Execs Appeal

Law.com

February 7, 2023

CASE HIGHLIGHTS

Media Mention

February 7, 2023

2nd Circ. Denies Ex-Xerox Execs Bid To Toss SEC Gag Order

Source: Law360

Press Release

April 25, 2022

Prominent 1st Amendment Scholars, Investors and Think Tanks Support NCLA’s SCOTUS Cert Petition

Media Mention

February 7, 2023

Can the S.E.C. Require ‘Gag Orders’ When It Settles Cases?

Source: The New York Times