Cases

Lucia v. SEC

CASE: Lucia v. Securities and Exchange Commission

STATUS: Closed

NCLA ROLE: Counsel

COURTS HEARD IN: 9th Cir., S.D. CA

ORIGINAL COURT: U.S. Securities and Exchange Commission Administrative Proceeding

OPENED: October 2, 2018

AGENCIES: Securities and Exchange Commission

FOCUS AREAS:

CASE SUMMARY

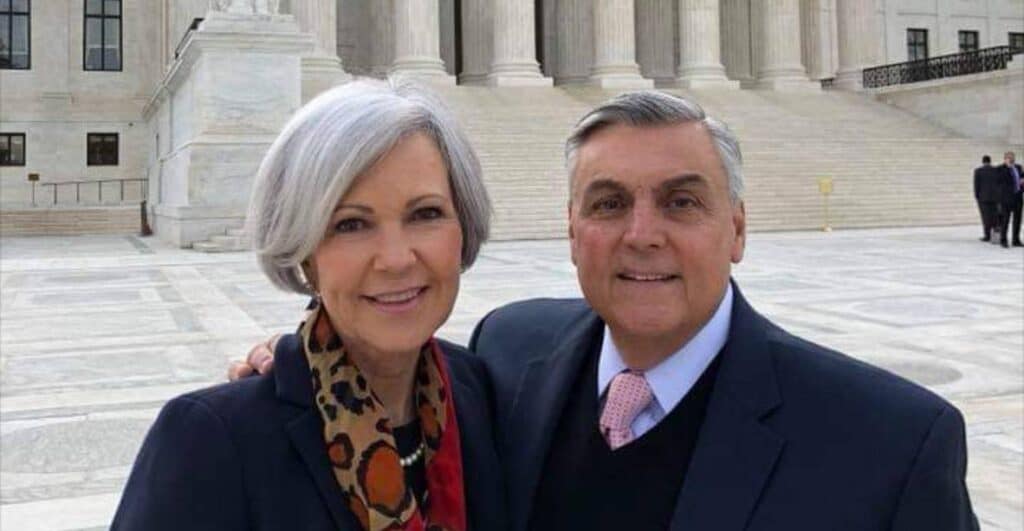

Did we achieve our litigation objective? Partially, as Ray Lucia settled his case on favorable terms.

Court Outcome: The client dropped his case against the SEC.

Larger Impact: Ray Lucia’s case caught the attention of Michelle Cochran, who chose NCLA to represent her against the SEC. Cochran’s case resulted a 9-0 victory against the SEC in the U.S. Supreme Court on the very same legal issues at stake in Ray Lucia’s case.

Summary: In 2018, NCLA filed a complaint seeking declarative and injunctive relief against the U.S. Securities and Exchange Commission (SEC) in the U.S. District Court for the Southern District of California in the case of Ray Lucia and his former company. The suit before Judge Sabraw sought to prevent Mr. Lucia from being compelled to submit—yet again—to a proceeding before an unconstitutional Administrative Law Judge (ALJ) at the SEC. NCLA also represented Mr. Lucia in the related matter remanded for hearing before “a properly appointed official … or the Commission itself.”

Mr. Lucia suffered irreparable professional, reputational and financial harm from the SEC’s first unconstitutional proceeding. He subsequently endured several years of protracted litigation successfully taking his case all the way to the U.S. Supreme Court based on the argument that the first ALJ he appeared before was improperly appointed.

Rather than retrying the remanded Lucia case before the Commission itself or in federal district court, as it easily could have done, the SEC chose to proceed once again in front of a constitutionally defective ALJ. That time, the SEC knew full well that the ALJ is defective, because the U.S. Solicitor-General conceded as much in filings and argument before the U.S. Supreme Court. The problem was that the ALJ enjoyed multiple layers of protection from removal, which the Supreme Court had deemed unconstitutional. Mr. Lucia also had remaining constitutional objections.

On June 16, 2020, NCLA finally negotiated a settlement with the U.S. Securities and Exchange Commission (SEC) on behalf of its clients. Mr. Lucia waged a long, contentious battle, refusing to bow to an agency with unlimited resources unwilling to admit that its prosecution efforts had become wholly disproportionate to the alleged infraction. Having fought this landmark case all the way to the U.S. Supreme Court once to vindicate his right to be tried before a lawfully appointed administrative law judge (ALJ), this settlement allowed Ray to get on with his life.

In the settlement, Mr. Lucia neither admited nor denied wrongdoing, and he was immediately eligible to reapply for association with registered entities such as securities brokers as well as to serve as an employee for related entities. In exchange for the final resolution of all claims against him, Mr. Lucia agreed to pay a penalty of $25,000 and to drop his affirmative case against SEC.

OUR TEAM

ADDITIONAL VIDEOS

Silenced for Life: The Injustice of Government Censorship of Speech

The Punishment is the Process

RELEVANT MATERIALS

NCLA FILINGS

Order Making Findings and Imposing Remedial Sanctions and a Cease-And-Desist Order

June 16, 2020 | Read More

Appellants’ Opening Brief in the United States Court of Appeals for the Ninth Circuit

January 29, 2020 | Read More

Order Denying Appellants’ Motion for an Injunction Pending Appeal

January 23, 2020 | Read More

Appellants’ Reply Brief in Support of Their Motion for Injunction Pending Appeal

January 9, 2020 | Read More

Appellants' Opposed Motion for Injunction Pending Appeal

December 4, 2019 | Read More

PRESS RELEASES

Ray Lucia’s Sweetheart Settlement Proves that for the SEC the Sour Process Is the Punishment

June 17, 2020 | Read More

NCLA Asks Ninth Circuit Court of Appeals to Halt Unconstitutional SEC Hearing

December 4, 2019

NCLA Files Suit Over Unconstitutional SEC Appointees

November 29, 2018

IN THE MEDIA

After Almost a Decade of Fighting, the SEC and Ray Lucia Finally Settle, Investment News

Investment News

February 7, 2023

Lucia Ends Eight-Year Battle with the SEC

Regulatory Compliance Watch

February 7, 2023

‘Buckets of Money’ Advisor Settles With SEC After Long Legal Battle

ThinkAdvisor

February 7, 2023

Radio host Ray Lucia settles with SEC but war over ALJ removals wears on

Reuters

February 7, 2023

Biden’s Hurdle: Courts Dubious of Rule by Regulation

The Wall Street Journal

February 7, 2023

CASE HIGHLIGHTS

Media Mention

February 7, 2023

Radio host Ray Lucia settles with SEC but war over ALJ removals wears on

Source: Reuters

Media Mention

February 7, 2023

‘Buckets of Money’ Advisor Settles With SEC After Long Legal Battle

Source: ThinkAdvisor

Press Release

June 17, 2020

Ray Lucia’s Sweetheart Settlement Proves that for the SEC the Sour Process Is the Punishment