Cases

Murphy, Murphy, and Gounaud v. SEC

CASE SUMMARY

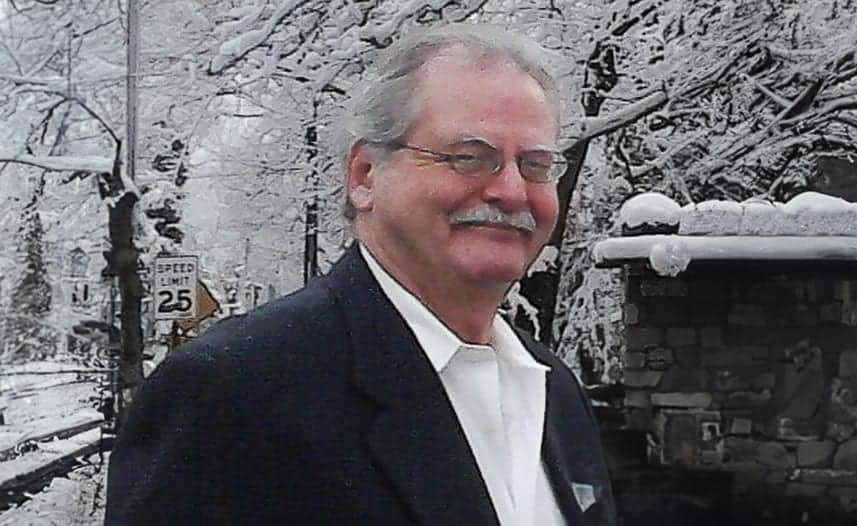

Securities and Exchange Commission (SEC) penalties have exploded in size in recent years, in large part because the agency ignores statutory penalty caps Congress set in 1990. SEC civil penalties have become wildly inconsistent and unpredictable from case to case, depriving regulated parties of any semblance of fair notice about the potential consequences of their behavior. On behalf of its client Richard Gounaud, NCLA asked the U.S. Supreme Court to stop SEC from counting the number of violations in arbitrary ways when seeking penalties, to clarify who must register with SEC as a “broker,” and to uphold jury trial rights when the government seeks to impose punitive sanctions.

Mr. Gounaud was fined more than $300,000—without a jury trial—for not registering with SEC as a securities broker under the Securities Exchange Act of 1934, a penalty Congress capped below $10,000. SEC obtained a penalty more than 30 times the statutory cap by convincing the U.S. District Court for the Southern District of California and the U.S. Court of Appeals for the Ninth Circuit to count each month Mr. Gounaud was unregistered as a separate violation. This arbitrary approach has no textual basis in the Securities Exchange Act, obliterates the statutory cap for this strict liability offense, and violates the Excessive Fines Clause of the Eighth Amendment. SEC also convinced these lower courts to adopt a novel interpretation of who must register as a securities broker—one that threatens to require many market participants to register who never before considered themselves brokers.

RELEVANT MATERIALS

NCLA FILINGS

Petitioners’ Reply Brief in Support of Petition for a Writ of Certiorari

October 10, 2023 | Read More

Brief for the Respondent in Opposition

September 27, 2023 | Read More

Brief of Securities Scholars and Former SEC Officials as Amici Curiae in Support of Petitioners

July 27, 2023 | Read More

Brief of Investor Choice Advocates Network as Amicus Curiae in Support of Petitioners

July 27, 2023 | Read More

Petition for a Writ of Certiorari

June 23, 2023 | Read More

PRESS RELEASES

NCLA Asks Supreme Court to Rein in SEC Practice of Seeking Penalties in Excess of Statutory Caps

June 26, 2023 | Read More